The word “Trusts” has likely cropped up in conversations around building your Family Office. What exactly is a Trust, and how can it be used as a tool for legacy and wealth preservation?

At its core, a Trust is a private legal agreement allowing you (the Settlor) to entrust selected assets (known as the Trust Assets or Funds) to a chosen Trustee – typically an individual or institution. As the Settlor, you have significant control over the Trust, deciding which assets to include and how the Trustee should distribute these assets to your specified Beneficiaries. This arrangement brings about a wide spectrum of benefits including wealth preservation and legacy planning.

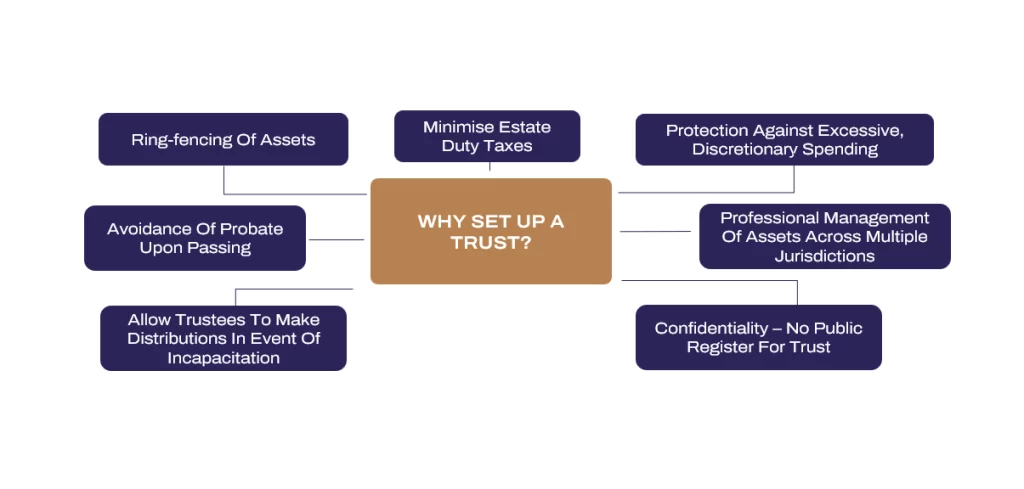

Benefits of Establishing a Trust

Trusts offer a suite of advantages designed to enhance the management and protection of your family’s wealth and legacy. Highlighted below are some of the key benefits to setting up your family’s Trust.

- Ring-fencing of Assets: Ring-fencing ensures your wealth is safeguarded from external liabilities and claims, preserving it for your beneficiaries.

- Minimising Estate Duty Taxes: Trusts are designed to effectively reduce the tax impact on your estate, maximising the wealth passed on.

- Protection Against Excessive, Discretionary Spending: Trusts regulate the timing and amount of asset distribution, reducing imprudent spending and maintaining your wealth for successive generations.

- Professional Management of Assets Across Multiple Jurisdictions: With a Trust, you gain the advantage of professional asset management, ensuring your wealth is well-managed and compliant with international regulations.

- Confidentiality: The privacy of your Trust arrangements and the identity of your beneficiaries are preserved, keeping sensitive financial information out of the public domain.

- Trustee Distribution in the Event of Incapacitation: If you become unable to manage your affairs, the Trust structure ensures that trustees will distribute your assets in alignment with your established wishes, providing continuity and security.

- Avoidance of Probate: Trusts bypass the lengthy and public probate process, allowing for a swift and private transfer of assets to your beneficiaries while preserving confidentiality.

Key Features of a Trust

Some of the key features of a Trust include:

- Right to Information: Beneficiaries are entitled to be informed about the assets and accounts held by the Trust, ensuring transparency in its operations.

- Unlimited Liability: Trustees bear personal liability for the Trust’s liabilities and expenses. While their accountability is extensive, it can be moderated by the terms specified in the Trust Deed.

- Life of a Trust: A Trust can be established for a considerable duration, with some trusts having the potential to last up to 100 years, providing a long-term approach to asset management.

- Legal Ownership: The Trust itself holds legal title to the assets, managed by the trustee, while the beneficiaries retain a beneficial interest, creating a clear division of control and benefit.

- Capital Gain and Income Accumulation: Trust assets can appreciate in value and earn income over the Trust’s lifespan. This income can be distributed periodically to beneficiaries according to the stipulations of the Trust Deed.

These features underscore the Trust’s role as a tool for asset protection and succession planning, ensuring that assets are managed per the Settlor’s intentions.

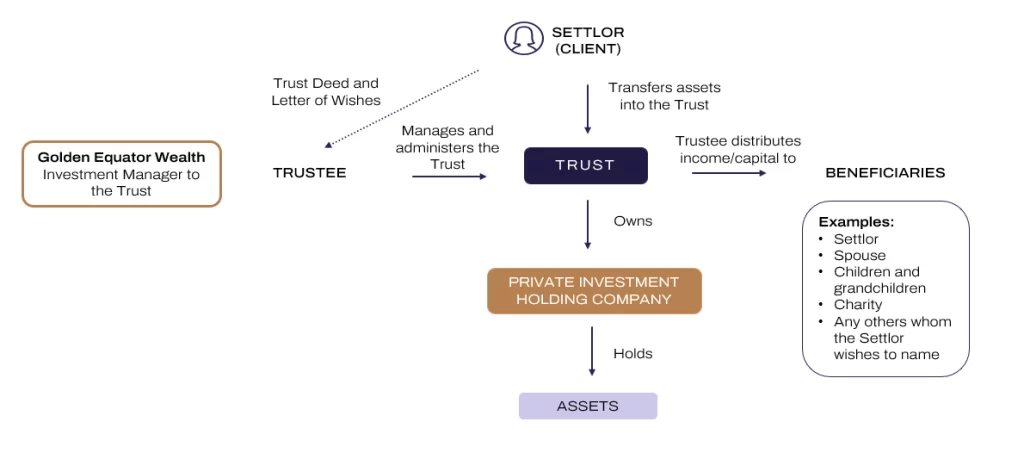

How is a Trust Structured to Benefit You?

A Trust structure is essential for managing and preserving wealth within a family. The diagram we’ve provided paints a clear picture of a Trust’s framework.

The Settlor is you, the individual who initiates the Trust, transferring your assets into the Trust’s care. As the asset owner, your vision and intentions shape the Trust’s purpose and goals.

Trustees are appointed to act in the best interest of the Trust. They are legally obligated to carry out your wishes as outlined in the Trust Deed, which includes responsibilities like maintaining records, managing taxes, and making distributions to the beneficiaries. In Singapore, trustees are bound by the Trustees Act and Common Law, ensuring they meet stringent standards of Trust management.

Beneficiaries (also commonly known as Beneficial Owners) are individuals designated to benefit from the Trust, typically encompassing your family members and potentially future descendants. They are the ultimate recipients of the Trust’s assets, as directed by the terms of the Trust.

An Investment Manager, such as Golden Equator Wealth, is often engaged to optimise the financial performance of Trust Assets. The role involves working with the Settlor/Trustee (the Trust), offering specialised investment advice and managing the investments according to the authorised investments listed in the Trust Deed. Ultimately, this is done to safeguard your wealth for the benefit of your chosen Beneficiaries.

The Trust Deed (also known as the Deed of Settlement or Declaration of Trust), serves as the Trust’s cornerstone. This comprehensive legal document details the terms and conditions of the Trust, ensuring that your intentions are clearly articulated and legally binding. This document also outlines crucial aspects such as income distribution, asset allocation, distribution timelines, and preferred investment strategies. The appointed Trustee is legally mandated to manage and allocate the Trust’s assets faithfully according to the Trust Deed, honouring any supplementary instructions you may provide in a Letter of Wishes.

Trusts: A beneficial tool for wealth preservation and succession planning

Establishing a Trust offers decisive advantages for asset management and estate planning.

They are structured in a way to shield your assets, sparing your beneficiaries from the public, often drawn-out probate process, while providing immediate asset protection against creditors. A Trust also allows for precise control over inheritance, safeguarding the interests of minors or beneficiaries who may not be ready for sudden wealth.

Notably, a Trust maintains family wealth within the bloodline, insulated from external claims such as divorce settlements, and ensures business continuity through clear succession planning. Moreover, the confidentiality of beneficiary distributions is preserved, keeping your estate matters discrete.

In contrast, the absence of a Trust could lead to frozen assets, protracted probate proceedings, and potential disputes that can threaten the stability of your business and delay the transfer of your legacy. Thus, a Trust structure is integral to a strategic, forward-thinking approach to preserving and transferring your wealth.

At Golden Equator Wealth, we work closely with established Trust services providers to ensure your wealth is safeguarded for generations to come. Interested to find out more? Reach out to us for a non-obligatory consultation with our Family Office Advisors at [email protected].

Sources: